What is a Cash Balance Plan?

A cash balance plan is a type of qualified pension plan in which the employer guarantees a contribution level and a minimum rate of return. Often referred to as a hybrid plan, a cash balance plan has many charac- teristics of both a defined benefit and defined contribution plan. The plan defines the promised benefit in terms of a stated account balance and combines the high contribution amounts of a traditional pension plan with some of the flexibility and portability of a defined contribution plan.

How Does it Work?

Typically, the employee does not contribute to the plan. The plan trustee(s) and/or a designated investment manager invest employer contributions in a pooled account. The participant does not choose their own investments.

- Each participant’s “account” receives an annual contribution credit, which is usually a percentage of compensation, but can be a flat dollar amount

- The employer contributes based on employees’ salaries, ages, and number of years to retirement (most beneficial to highly compensated employees and those nearing retirement)

- A guaranteed interest rate is credited to “accounts” (based on either a fixed rate or a variable rate that is linked to an index such as the thirty year Treasury bill rate)

- If annual gains are higher than the set interest rate, the excess is used to offset future employer contributions

- If annual gains are less than the set interest rate (or if there is a loss), the employer may need to increase future contributions (shortfalls can be amortized)

- Must pass required non-discrimination testing

- When the employer offers a 401(k) and/or profit sharing plan in addition to a cash balance plan, itcan help the retirement program pass nondiscrimination testing

How is it Different than a 401(k) Plan?

Cash balance plans, like most defined benefit plans, generally do not depend on the employee contributing part of their compensation to the plan. Additional differences include:

- Employer bears investment risks

- The benefits in most cash balance plans are protected, within certain limitations, by federal insuranceprovided through the Pension Benefit Guaranty Corporation (PBGC)

- Employer is required to offer employees the option to receive their benefits as lifetime annuities, including joint and survivor annuities (most participants elect lump sum options with spousal consent)

Why a Cash Balance Plan?

Cash balance plans offer high contribution limits, like that of a traditional defined benefit plan, while providing the portability of a 401(k) plan. Advantages include:

- Ability to provide equitable benefits among partners with different ages and lengths of service

- Transparency: employees can see their “accounts” grow, which enhances appreciation of employer provided benefits

- Portability: most plans permit employees to roll their balance into an individual retirement account (IRA) upon termination/retirement

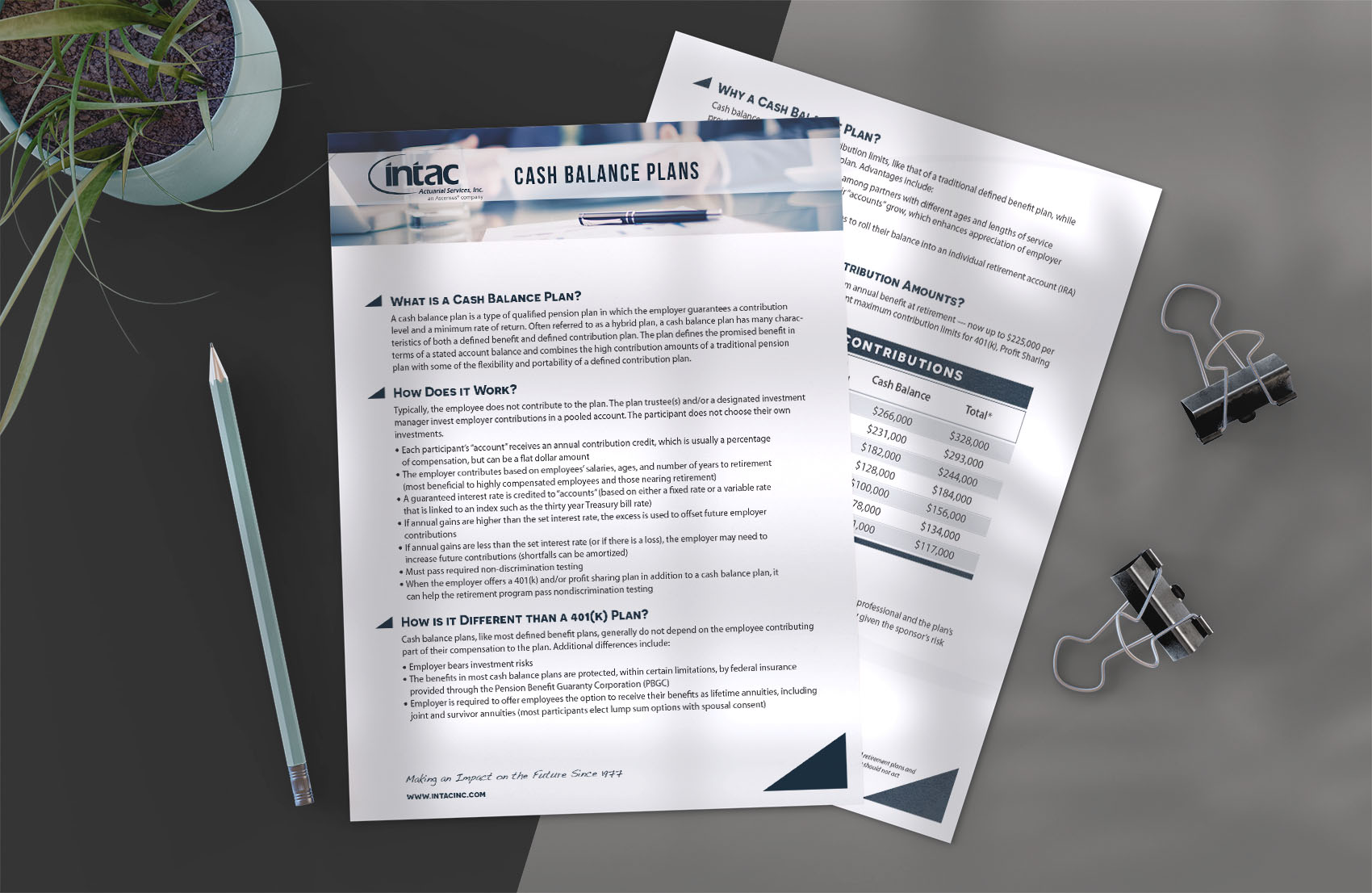

What are the Maximum Contribution Amounts?

In 2001, tax law changes increased the maximum annual benefit at retirement — now up to $225,000 per year in 2019. Below is a chart reflecting the current maximum contribution limits for 401(k), Profit Sharing and Cash Balance plans.

2019 maximum contributions

|

AGE |

401(k) Only |

401(k) with Profit Sharing |

Cash Balance |

Total* |

|

60 – 65 |

$25,000 |

$62,000 |

$266,000 |

$328,000 |

|

55 – 59 |

$25,000 |

$62,000 |

$231,000 |

$293,000 |

|

50 – 54 |

$25,000 |

$62,000 |

$182,000 |

$244,000 |

|

45 – 49 |

$19,000 |

$56,000 |

$128,000 |

$184,000 |

|

40 – 44 |

$19,000 |

$56,000 |

$100,000 |

$156,000 |

|

35 – 39 |

$19,000 |

$56,000 |

$78,000 |

$134,000 |

|

30 – 34 |

$19,000 |

$56,000 |

$61,000 |

$117,000 |

*Assumes the cash balance plan is subject to PBGC governance.

Is a Cash Balance Plan Right for You?

An employer should work with its financial advisor, accountant, an actuarial professional and the plan’s investment manager to determine the most appropriate plan design strategy given the sponsor’s risk tolerance and cash flow.